Buying your first home in today’s competitive market can be tough, but you can improve your chances with the right strategy. Here’s a quick guide to help you stand out in bidding wars:

- Get Pre-Approved: Show sellers you’re financially ready by securing a mortgage pre-approval.

- Set a Budget: Stick to what you can afford by following the 29/41 rule (housing costs ≤ 29% of income, total debt ≤ 41%).

- Make a Strong Offer: Bid competitively, consider a larger earnest money deposit, and adjust contingencies thoughtfully.

- Act Fast: Homes sell quickly – be ready to move fast with tools like 3D tours and clear communication with the seller’s agent.

- Tailor Your Offer: Understand what the seller values most, like flexible closing dates or appraisal gap guarantees.

- Know Your Limits: Avoid overspending by setting boundaries before entering the bidding process.

With preparation, financial clarity, and a solid team, you can navigate bidding wars and secure your dream home.

How to Win a Real Estate Bidding War (and NOT OVERPAY)

Getting Ready Before You Bid

These steps will help you prepare before making an offer.

Get Pre-Approved for a Mortgage

Sellers tend to prefer buyers who come with verified financing. A pre-approval shows that your finances are in order and gives sellers confidence in your ability to close the deal [1]. It outlines your maximum loan amount, estimated interest rate, eligible mortgage program, and verified income.

Know Your Maximum Budget

Set a clear budget to avoid getting carried away in a bidding war. A common guideline, the 29/41 rule, suggests keeping housing costs under 29% of your gross monthly income and total debt-to-income ratio below 41% [2].

Here’s what to consider when setting your budget:

- Calculate your debt-to-income (DTI): (monthly debts ÷ gross income) × 100

- Account for additional costs: taxes, insurance, and HOA fees

- Factor in savings: subtract your down payment and any assistance

Don’t forget to set aside funds for future repairs and maintenance.

Choose Your Support Team

Having the right professionals on your side can make all the difference. Consider these key players:

- Buyer’s Agent: Offers market insights, provides comparable sales, and negotiates on your behalf

- Loan Officer: Handles pre-approval and helps structure your financing

- Home Inspector: Identifies potential issues that could impact the property’s value

Working with local experts ensures your offer is competitive and aligns with your financial plan.

With pre-approval, a clear budget, and a solid team, you’ll be ready to make a strong bid.

[1] Keeping Current Matters, "Why Pre-Approval Should Be at the Top of Your Homebuying To-Do List."

[2] First-time homebuyer guideline: monthly housing expenses ≤29% of gross income; total debt-to-income ratio ≤41%.

Making Your Offer More Competitive

Now that you’re prepared, it’s time to fine-tune your offer to stand out from the competition.

Price Your Offer Right

Leverage local comparable sales to determine a price that positions you competitively. Take into account the property’s condition, recent sales data, market trends, competing offers, and your financial limits. A knowledgeable local agent can provide insights into recent sale prices and what it takes to secure the deal.

Show Financial Strength

Earnest Money Deposit (EMD)

Offering a larger earnest money deposit – beyond the typical 1–2% – can demonstrate your commitment. Additionally, consider shortening or waiving contingencies, such as inspection or financing, to strengthen your position [3].

Adjust Contingencies Thoughtfully

Evaluate which contingencies you can reasonably adjust or eliminate to enhance your offer:

- Shorten the inspection period to show urgency.

- Carefully assess whether waiving certain contingencies is a viable option, keeping potential risks in mind.

Craft a Strong Offer Letter

Tailor your offer letter to align with the seller’s preferences and timeline. Listing agents play a key role in how offers are reviewed, so maintain professional and clear communication [3]. Highlight your flexibility to meet the seller’s needs, which can make your offer more attractive.

Include essential details like the purchase price, proof of funds, your proposed closing date, and any special accommodations for the seller.

Next: Learn how to handle the bidding process effectively.

sbb-itb-8115fc4

Managing the Bidding Process

Once you’ve refined your offer, act swiftly and adapt your terms to align with the seller’s preferences.

Act Fast When Needed

Speed matters in competitive markets. Tools like video tours and 3D walkthroughs can help you evaluate properties quickly. Additionally, having your lender reach out to the listing agent can make a strong impression. Sylva Khayalian, a Redfin listing agent in Los Angeles, highlights this approach:

"When I’m dealing with a multiple-offer situation, a huge plus is when the buyer’s lender contacts me to introduce themself and let me know that they’re on top of everything."[4]

Meet Seller Needs

Tailor your offer to what the seller values most. A few strategies include:

- Offering an appraisal gap guarantee

- Staying in regular contact with the listing agent to understand the seller’s priorities[4]

Know When to Walk Away

It’s important to stay within your financial limits to avoid regret later. Before bidding, set clear boundaries. Keep these tips in mind:

- Assess how long you plan to own the property before agreeing to exceed the appraisal

- Stick to your maximum budget above all else

- Ensure the purchase remains within your affordability range

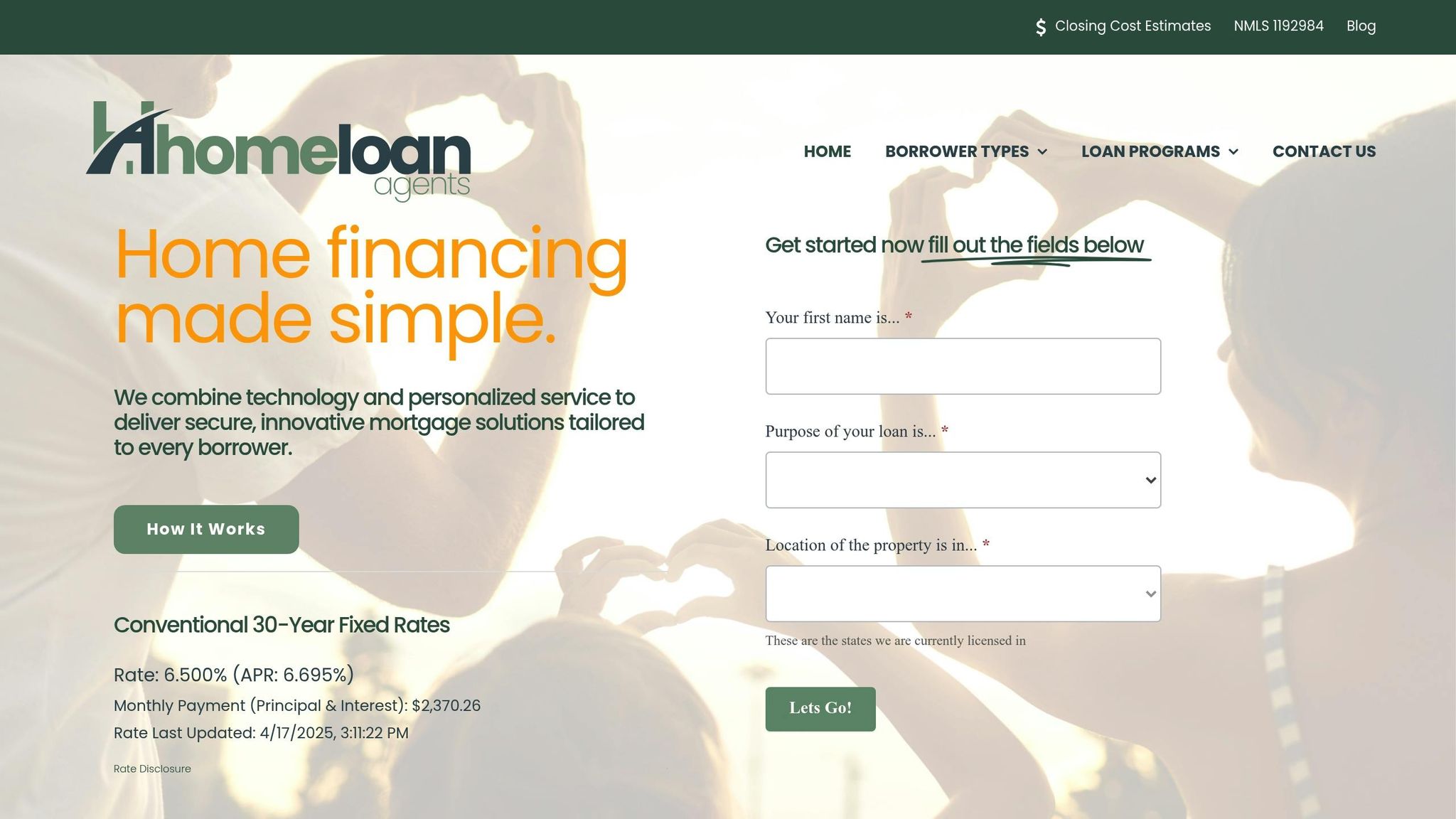

How HomeLoanAgents Helps You Compete

Once you’ve crafted a strong offer, HomeLoanAgents provides the tools and expertise to help you seal the deal.

Mortgage Programs for First-Time Buyers

HomeLoanAgents offers a variety of loan options designed to make homeownership accessible:

- Conventional 97: Requires just 3% down.

- FHA Loans: Suitable for buyers with less-than-perfect credit.

- Fannie Mae HomeReady & Freddie Mac HomePossible: Both offer low down payment options.

- Down Payment Assistance Programs: Helps cover upfront costs.

These programs often come with perks like lower rates and reduced insurance costs, giving you an edge in affordability.

Accelerated Pre-Approval

Speed up the process with advanced tools like AI-powered underwriting, digital income and asset verification, and e-Closing. These features streamline both pre-approval and closing, so you can move fast when it matters most.

Expert Loan Guidance

Get personalized support from HUD-approved counselors. They’ll assist you in creating a budget, identifying assistance programs, and keeping track of your loan’s progress from pre-approval to closing. Plus, you’ll have constant access to a dedicated advisor, ensuring you’re ready to act quickly and confidently when your dream home becomes available.

Conclusion: Steps for Success

Recent data reveals that 80% of buyers made multiple offers before successfully purchasing a home, with first-time buyers paying a median of $77,500 above the listing price [5]. If you’re a first-time buyer looking to navigate a bidding war, here are some practical steps to improve your chances:

Start with a strategic approach

Condominiums often attract less competition than single-family homes, making them a smart option to consider. Focus on listings priced 2–3% below your budget to give yourself room for stronger offers when needed [4].

Secure financing and stay ready

Using HomeLoanAgents’ fast pre-approval process and on-demand loan advisors can help you stay ahead of other bidders. You might also think about offering a non-refundable earnest money deposit to show your commitment [4].

Related posts