Want to stand out when buying a home? Start with mortgage pre-approval. It shows sellers you’re serious, helps you understand your budget, and speeds up the process. Here’s what you need to know:

- Pre-approval vs. Pre-qualification: Pre-approval is a detailed financial review with verified documents, while pre-qualification is a quick estimate.

- What’s included in pre-approval? Loan amount, interest rate, closing costs, and more.

- Key benefits: Stronger offers, faster closings, and a clear budget.

- How to prepare: Gather documents (W-2s, tax returns, bank statements), improve your credit score, and calculate your debt-to-income (DTI) ratio.

- Choosing a lender: Look for quick communication, local expertise, and tech-friendly tools.

Pre-approval is your golden ticket in today’s housing market. Stay financially stable, avoid new debt, and work with a reliable lender to secure your dream home.

Mortgage Pre-Approval: The Secret Process Explained

What Pre-Approval Means

Mortgage pre-approval is when a lender evaluates your finances to determine the maximum loan amount you can borrow. This involves a review of your credit score, income, debt-to-income ratio, and employment history to assess your financial situation and borrowing power [1]. Knowing these basics helps differentiate pre-approval from pre-qualification.

After you submit your application, lenders are required to provide a Loan Estimate within three business days. This document includes:

- Loan amount you’re approved for

- Type and term of the mortgage

- Interest rate

- Estimated closing costs

- Property taxes

- Homeowner’s insurance [1]

Pre-Approval vs. Pre-Qualification

| Feature | Pre-Qualification | Pre-Approval |

|---|---|---|

| Documentation | Minimal information | Detailed paperwork (bank statements, tax returns, W-2s) |

| Review Process | Quick estimate, self-reported data | In-depth review of verified financials |

| Credit Check | Soft inquiry (no credit score impact) | Hard inquiry (may affect your credit score) |

| Processing Time | A few minutes | 1–10 business days |

| Reliability | General estimate | Formal lender commitment |

Pre-approval not only helps you understand how much home you can afford but also makes you more competitive when negotiating in a busy market [2].

Benefits of Pre-Approval

Pre-approval has several perks: it shows sellers you’re a serious buyer, strengthens your position during negotiations, speeds up the closing process by handling much of the paperwork early, and gives you a clear budget to work with. Typically, pre-approval letters are valid for 60–90 days [1].

Important: Pre-approval shows how much you might be able to borrow but doesn’t guarantee the loan. Final approval depends on maintaining stable finances and employment [1].

Getting Ready for Pre-Approval

Getting pre-approved involves organizing your finances and presenting a strong application to secure better loan terms. Here’s how to prepare your documents and improve your financial standing.

Documents You’ll Need

Having the right paperwork ready will speed up the process with your lender [3]:

| Document Category | Items to Prepare |

|---|---|

| Identification | – Government-issued photo ID – Social Security card – Proof of address |

| Income Verification | – Last 2 years of W-2s – Recent pay stubs (past 30 days) – Tax returns (last 2 years) – 1099s for self-employment income |

| Financial Records | – Bank statements (2–3 months) – Investment and retirement account statements – Proof of other assets |

| Additional Documents | – Divorce decree (if applicable) – Gift letters for down payment help – Bankruptcy discharge papers (if applicable) |

Steps to Boost Your Credit Score

Start working on your credit score well before applying, ideally a year in advance. Even small changes can make a difference [4]. Here’s how:

- Review your credit reports for errors and dispute anything incorrect.

- Avoid opening new credit accounts and keep your credit utilization low.

- Pay all your bills on time – every single one.

Understanding Debt-to-Income Ratio (DTI)

Lenders pay close attention to your debt-to-income (DTI) ratio. A DTI of 36% or less, including your future mortgage payment, is often preferred [5].

To calculate your DTI:

DTI = (Total Monthly Debt Payments ÷ Gross Monthly Income) × 100

For example, if you have $2,000 in monthly debt and a $6,000 income, your DTI is 33.3%.

To lower your DTI, you could:

- Refinance existing loans for better terms.

- Use income-driven repayment plans for student loans.

- Focus on paying down debt more quickly.

sbb-itb-8115fc4

Finding the Best Lender

Picking the right lender can make all the difference, especially in a competitive housing market. A lender with solid expertise and quick, clear communication can boost your chances of securing pre-approval.

What to Look for in a Lender

When comparing lenders, focus on these factors to ensure a smooth home-buying process:

| Criteria | What to Look For | Why It Matters |

|---|---|---|

| Communication | Quick responses (within 24 hours), weekend availability | Lets you act fast in a fast-paced market |

| Pre-Approval Process | Full verification of credit, income, and assets | Makes you a stronger candidate to sellers |

| Market Experience | Understanding of local market trends | Helps navigate potential appraisal challenges |

| Technology | Online applications and digital submissions | Speeds up the entire pre-approval process |

| Reputation | Positive reviews on platforms like Yelp or LinkedIn | Reflects reliability and quality of service |

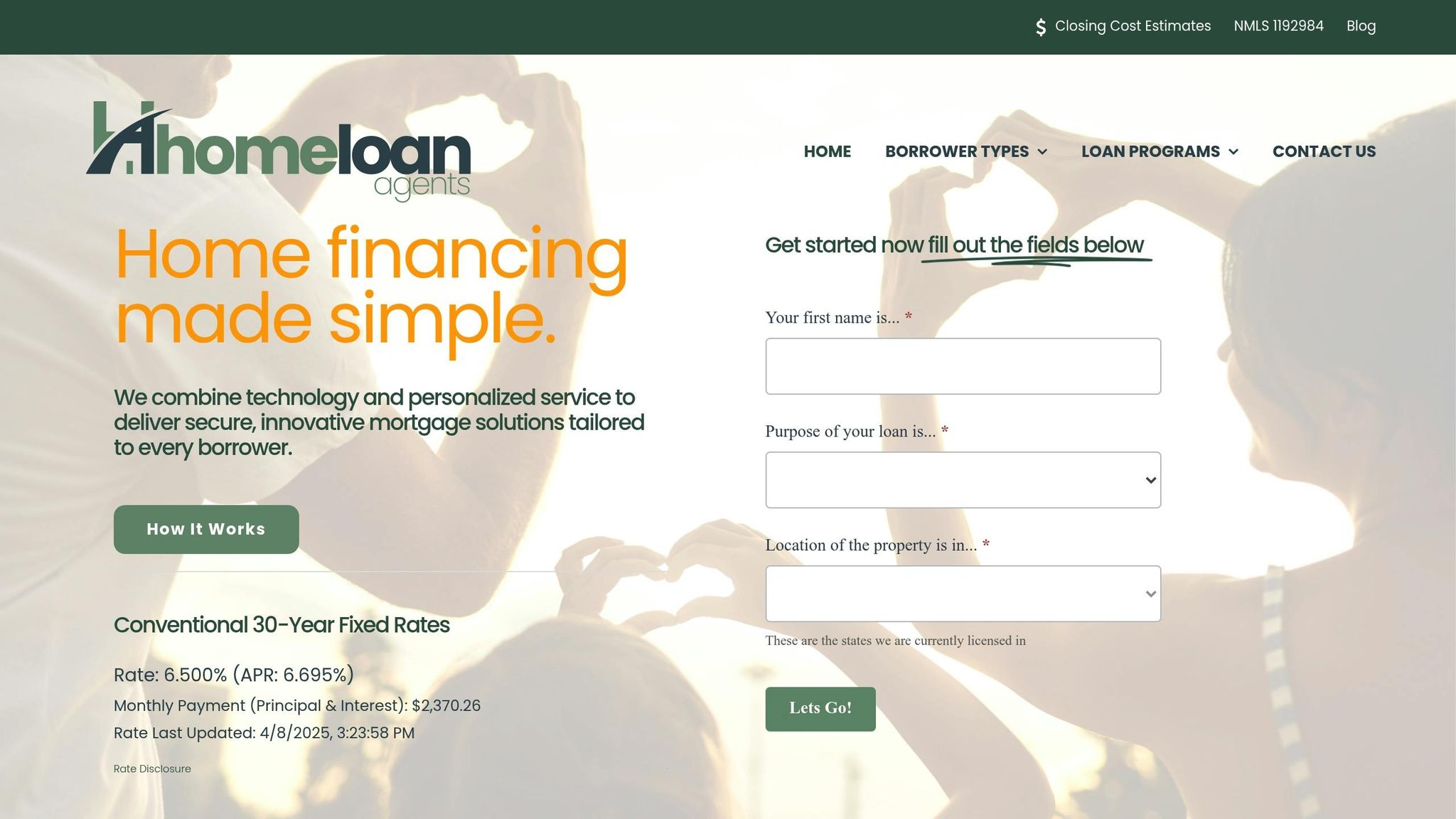

Want to test a lender’s responsiveness? Try contacting them through various channels to see how quickly they reply [6]. HomeLoanAgents is a great example of a lender that meets these high standards.

What HomeLoanAgents Offers

HomeLoanAgents simplifies pre-approvals with a tech-forward, personalized approach. Here’s what they bring to the table:

- AI-Driven Underwriting: Automates document checks and decisions.

- Digital Asset Verification: Links directly to your financial accounts for faster processing.

- Real-Time Updates: Lets you track your pre-approval status through a secure online portal.

- eClosing Options: Enables fully paperless closing for added convenience.

Their loan options include fixed-rate and adjustable-rate mortgages, along with tailored programs for different borrower needs. Licensed in states like California, Arizona, and Florida, HomeLoanAgents ensures compliance with all federal and state regulations while delivering a modern, efficient lending experience.

Tools for Better Pre-Approval

Using the right tools can streamline your pre-approval process and help you stand out as a serious buyer.

Pre-Approval Calculator Guide

A pre-approval calculator is a handy tool to estimate your maximum loan amount. You’ll need to provide details like:

- Monthly income and debts

- Available down payment funds

- Credit score (FICO)

Based on this information, the calculator will give you an estimate of:

- The maximum home price you can afford

- A breakdown of your monthly mortgage payment

- The required down payment

- Estimated property taxes and insurance costs

Keep in mind: These are just estimates and may not reflect your final loan terms. Once you have this estimate, focus on keeping your financial situation stable.

Maintaining Pre-Approval Status

After estimating your loan potential, it’s essential to maintain your pre-approval status to avoid unexpected issues. To protect your standing, avoid:

- Applying for new credit

- Making large purchases that could raise your debt-to-income ratio

- Changing jobs

- Moving large sums between accounts

HomeLoanAgents offers a digital portal that tracks your financial profile and provides real-time alerts if any changes could impact your pre-approval. This feature ensures you’re always informed and prepared.

Writing Strong Pre-Approval Letters

A well-crafted pre-approval letter can boost your credibility in the market. Make sure it includes:

- Verified income: Proof of steady employment and earnings

- Down payment: Confirmation of available funds

- Loan amount: The maximum amount you’re approved to borrow

- Expiration date: Typically valid for 60-90 days

HomeLoanAgents’ AI-powered underwriting system creates detailed pre-approval letters that showcase your financial strengths with verified, up-to-date information.

Pre-Approval Facts vs Myths

Common Pre-Approval Myths

Let’s clear up some common misunderstandings that could complicate your home-buying process.

Myth: Pre-approval guarantees a mortgage.

Fact: Pre-approval is not a final promise. It’s conditional on full verification. As Chelsea Levinson puts it:

"Understand that just because you got a pre-approval doesn’t mean you’ll get a mortgage. That’s because all pre-approvals are subject to verification." [7]

Myth: Pre-approval and pre-qualification are the same.

Fact: Pre-approval involves a detailed review of your finances, while pre-qualification is a quick overview without deep verification [8].

Myth: You need perfect credit for pre-approval.

Fact: Lenders don’t expect flawless credit. They look at your overall financial situation, including income stability, debt-to-income ratio, and available funds for a down payment [8].

Knowing the truth behind these myths can help you navigate the process more confidently. Now, let’s look at what keeps a pre-approval valid.

Pre-Approval Requirements

Keeping your pre-approval intact means staying financially steady and avoiding risky moves during the process. Here’s what lenders focus on and how it affects your approval:

| Requirement Category | Lender Focus | Effect |

|---|---|---|

| Financial Stability | Income, savings, and assets | Must remain consistent throughout the process |

| Credit Performance | Credit score and payment history | Avoid new credit applications or missed payments |

| Employment Status | Work history and current job | Job changes can lead to a re-evaluation |

| Debt Management | Debt-to-income ratio | New debts or large purchases can void approval |

What can jeopardize your pre-approval?

- A low appraisal on the property

- Changes in your financial details

- A drop in your credit score

- Switching jobs

- Taking on new debt

- Missing payments

The strength of your pre-approval depends on how thoroughly your lender evaluates your finances. Picking a lender with a strong verification process can help you avoid surprises later on [7].

Conclusion

Getting mortgage pre-approval in today’s competitive housing market takes preparation and planning. Think of pre-approval as your "golden ticket" – it helps you understand what you can afford and shows sellers you’re a serious, qualified buyer. This can give you a strong edge when making offers.

Most pre-approvals are valid for 90 to 120 days [9], giving you a set timeframe to find and secure your dream home. To keep your pre-approval active, make sure your financial documents are current, avoid major financial changes, and seek advice from professionals when needed.

HomeLoanAgents simplifies the pre-approval process with AI-powered underwriting and real-time updates, helping you move closer to closing faster.

Related posts